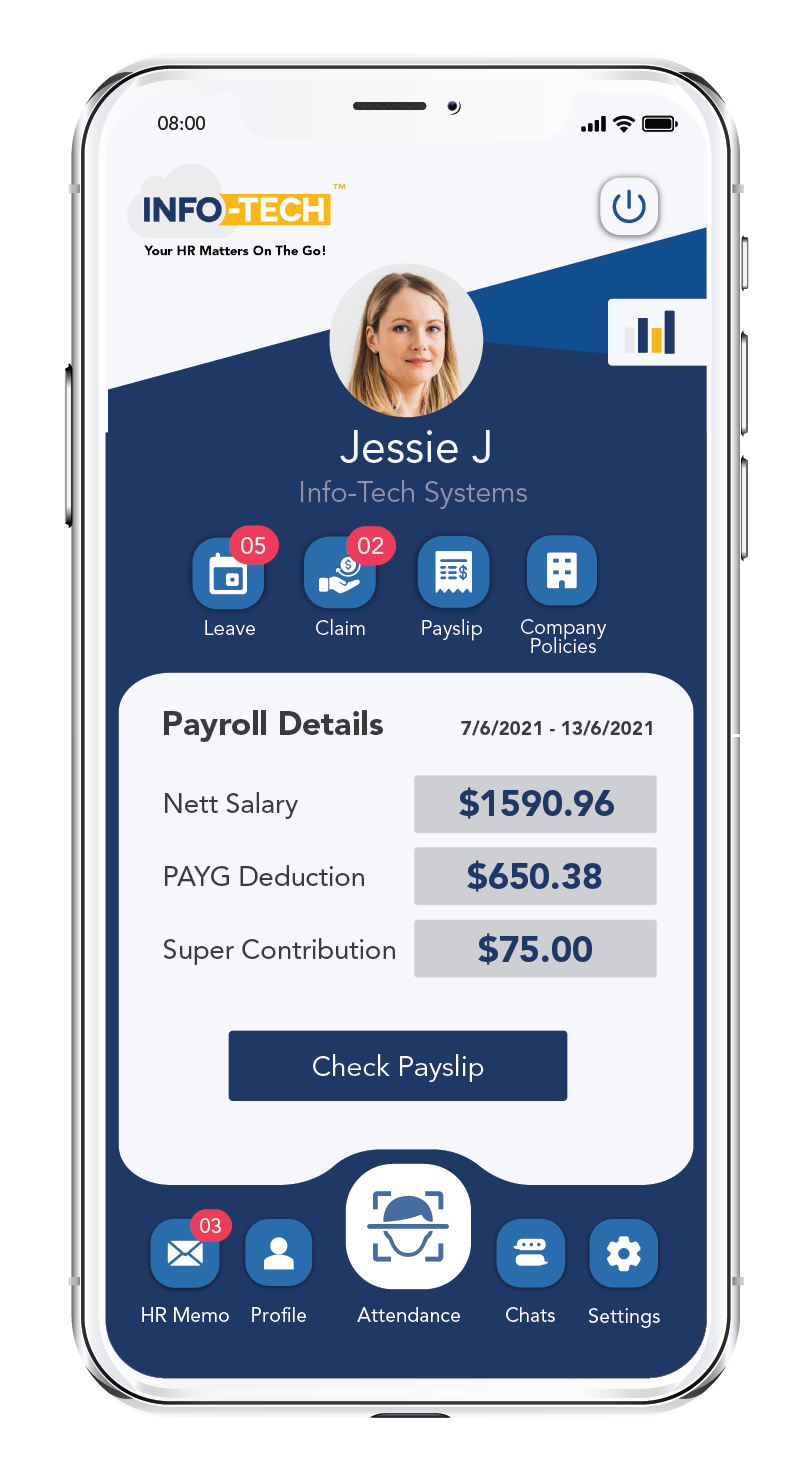

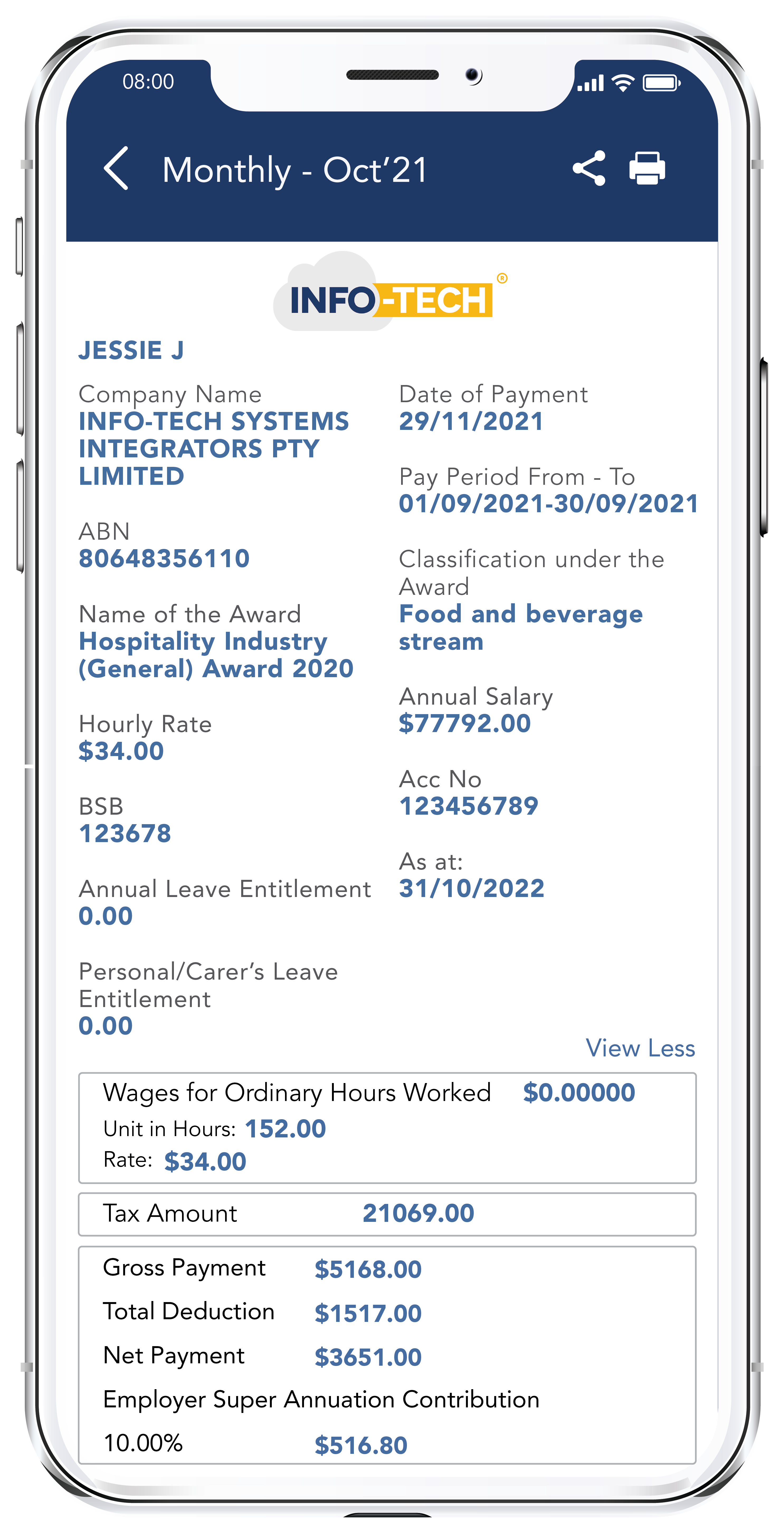

Simplify Salary & Statutory payments with Info-Tech's Payroll Software

Compliant with Single Touch Payroll (STP) Australia

Our Cloud based Payroll Software is compliant with the Single Touch Payroll (STP), simplify all aspects of payroll including PAYG withholding, SuperStream and more. Integrated with Time Attendance Software , Leave Management Software & Claims Management Software which eases your entire process of payroll calculation.

Download our Mobile App today!